Summary

Part 2 of the planning and executing in uncertainty series provides an overview of the tools and techniques for delivering change during periods of uncertainty and incorporating lessons learnt from the Covid-19 pandemic.

Part 1: Understanding uncertainty and the planning approaches available

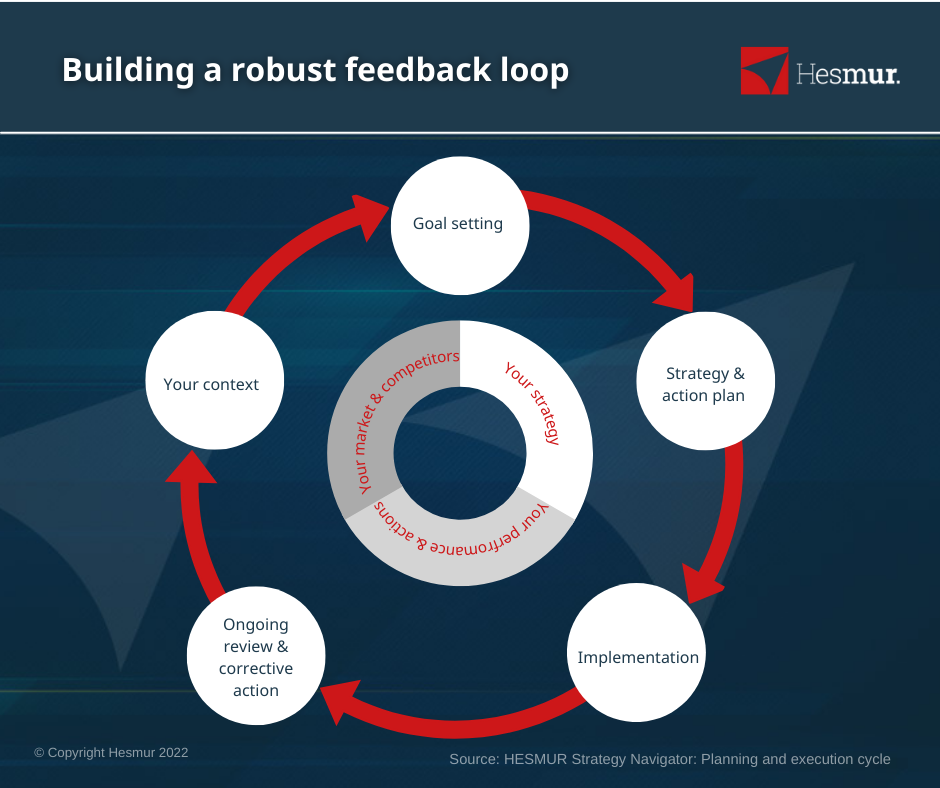

In traditional strategy and execution cycles, a periodic strategy development effort is usually followed by a longer period of execution. While execution plans are often tuned and realigned, the core strategy and objectives are rarely revisited. During times of uncertainty, this linear approach risks being out of step with changes in the market when much greater levels of feedback are required to test and guide decision-making.

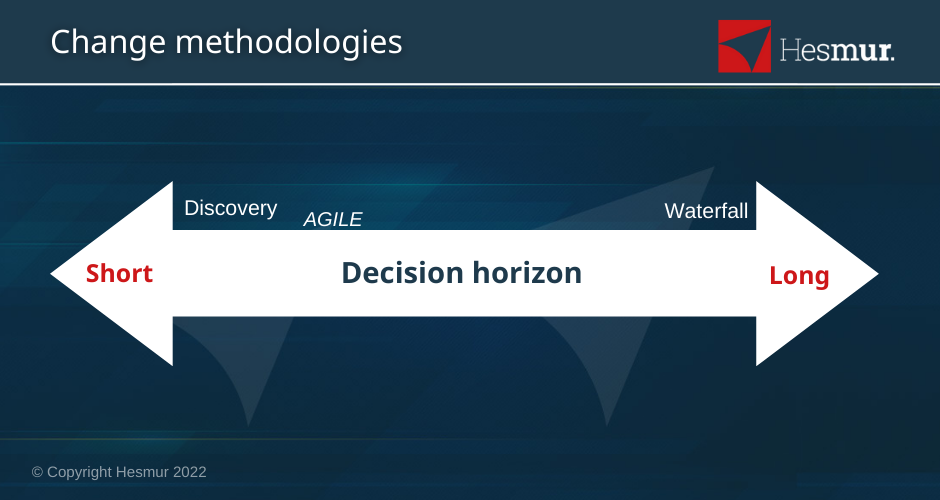

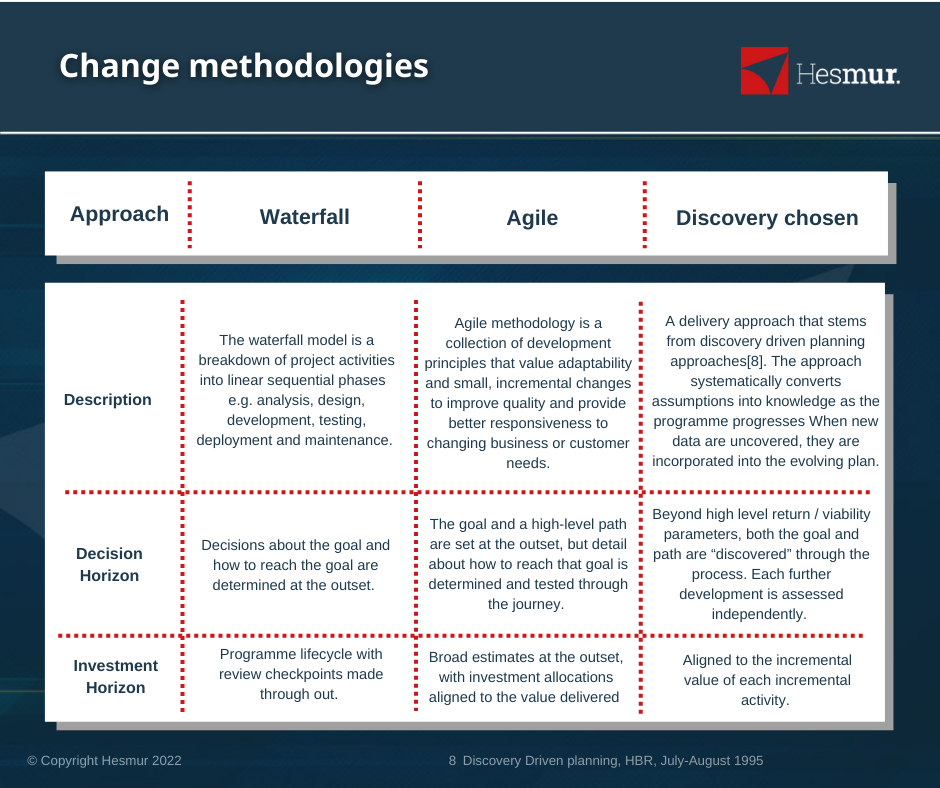

To mitigate this risk, many firms have adopted agile or discovery-based approaches to better align decision-making and investment horizons with different levels of uncertainty and adjust to the unknown pace. Agile or discovery-based approaches can be used both in the context of wider strategic options as well as in the delivery of specific change programmes.

“No regrets” actions

While agile or discovery-driven approaches are clearly more aligned to greater levels of uncertainty (and the related commitment to a particular course of action or investment requirement), regardless of the approach taken, it is important for firms to identify the no regrets actions they can take. These are actions that will either have a positive payoff in themselves or are required regardless of the strategic options taken forward. By identifying these actions, firms can maintain forward momentum while minimising the risk of wasted effort or investment.

Change methodologies

The virtuous circle of understanding, strategy development, execution, and frontline feedback is important in normal times and critical in times of uncertainty. Not only does this include a robust market intelligence approach but also a strong internal feedback mechanism that actively tracks the impact of the firm’s actions and activities. Given their focus on active market testing, agile and discovery-based implementation approaches can be useful in providing elements of this feedback loop, but firms should also look to formalise this feedback more broadly to ensure actions are aligned with changing conditions.

Lessons from the crisis

The initial shock of lockdown proved to be a galvanizing force for many firms as they focused on getting remote operations up and running. But, for many organisations that momentum slowed as the path ahead became less clear[2]. It was those firms that were able to quickly assess the fundamentals of their markets, fill gaps in their business model and maintain strategic direction that were better able to weather the storm and, in many cases, thrive. This even included businesses in the hardest hit segments, with restaurants that pivoted to offer takeaway, health clubs switching to online offerings and in-person sales forces moving to virtual meetings and digitally enabled sales.

In doing this, these firms demonstrated three characteristics critical to succeeding in periods of uncertainty:

1. The ability of leaders to ask the right questions about the fundamentals of their business, even when they do not have all the answers.

2. Real organisational agility and the ability to rapidly adapt the organisation as situations changed.

3. A realisation that financial resilience was more than cost cutting, but instead a focus on maintaining the firm as a going concern.

What is clear is that succeeding in times of uncertainty is equally dependent on strong leadership as it is applying effective methodologies and being truly agile. In the final article in the planning and executing in uncertainty series, we delve into the questions leaders of financial service providers must ask during times of uncertainty.

References

[1] Hesmur Strategy Navigator

[2] Hesmur Research Strategic and Business Planning: insights on process and practices in prolonged uncertainty

Contact us

Call: +442045742661

email: info@hesmur.com