Summary

The dawn of the digital sales and distribution model during times of rising customer expectations means striking the right balance between traditional sales delivery and digital delivery to create a “bionic” offering in pensions, investments and wealth. In the first article of the Sales and Distribution Digitisation Series, we begin to explore the current state of play and the role of technology in delivering a customer-focused system infrastructure that delivers better customer experiences.

Changing times for financial services sales and marketing

With the market lurching between traditional models and full direct-to-consumer (D2C) offerings, a middle ground needs to be found that mates the cost-effectiveness and customer choice of D2C and the experience and advice of traditional offerings.

Rather than full “robo” or contactless D2C, we see a “bionic” offering that augments traditional players; agents and IFAs, whilst also giving an ultimate choice for engagement channel to the customer.

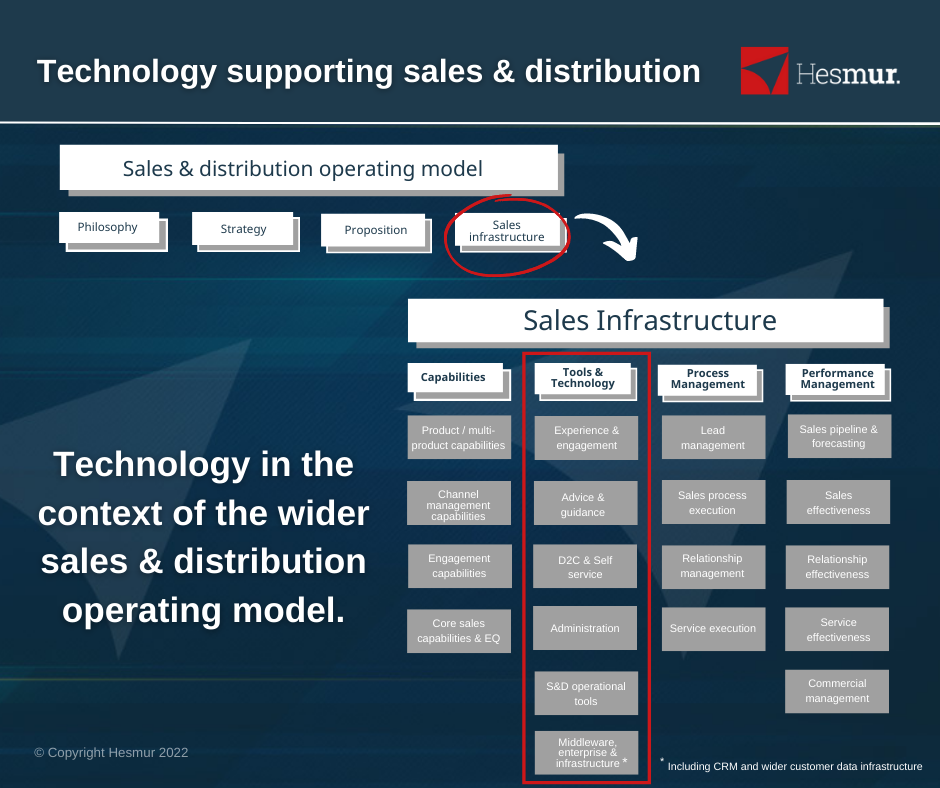

As an integrated part of the sales and distribution operating model, we see technology supporting sales and distribution in key areas across the entire customer lifecycle and an omnichannel digitally enhanced customer experience journey supported by the appropriate and integrated IT infrastructure.

“The customer must be at the centre of your systems, with your enabling infrastructure for sales and marketing supporting your customer at end delivery. To prevent disjointed customer communications and ensure better alignment between your sales and marketing contact via your sales distributors and all customer interactions. These are fundamental principles to better customer communication.”

Jim C Smith – Hesmur partner and Senior Financial Services Executive and non-executive Director

Illustrating the role of technology:

But it’s not just about the technology

While the focus of the discussion is often on the technology supporting a digital sales and distribution model, it is important to highlight its context in the broader operating model.

Rarely does a tool or technology materially impact commercial performance if the other operating model elements are not in place and/ or if the technology has not been designed or implemented in a way that complements the desired operational strategy or processes.

Nowhere is this more important than in sales and distribution, where the core sales capabilities and “EQ” are difficult to replace with technology (Read more on digital EQ here). Instead, opportunities for technology to augment this core capability and enhance the customer journey should be sought.

The pandemic has brought this issue into sharp focus. Whether trying to use traditional collateral on teams calls, building rapport remotely or truly giving a choice about how they engage, all components need to work together to be effective.

Many parts of the market have a long way to go.

In a recent survey of pensions and investment providers and distributors, we found that the majority of participants rated themselves as immature, with limited tools/technology available that was limited due to siloed awareness or use across the key categories of sales and distribution technology.

Not unexpectedly, a modest exception to this was in the administration space, where the average response was moderately mature (Core tools available, but room for improvement in awareness, use and/or configuration). This was mainly due to the widespread use of platforms in the market. But even in this space, it was noted that the systems were very product-focused rather than customer-focused, and in the case of firms with multiple platform relationships or on and off platform offerings, little integration exists across these systems, making it difficult to build a 360 or detailed view of clients and customers and their entire customer journey.

It’s inevitable that the future of pensions, investments and wealth involves greater technology integration as data and its use plays an increasingly critical role in business success. Technology and innovation across the sector may well advance at speed, as the financial services industry is now no stranger to this new digital era.

Where to start

It is never too late to innovate, so even if your firm is still early in the journey of using technology to augment your sales and distribution processes, a logical place to start is with your customer and, by extension, your customer relationship management (CRM) system. While CRM systems have a chequered history due to poor design (Read our blog – What does your sales and distribution team really think of your CRM?), a well-designed system can make your team more efficient and effective and deliver better customer service whilst building rich insights about your clients and prospective clients otherwise impossible to build.

Related articles:

CRM Series article 1: CRM is a central component to successful digitisation in financial services

CRM Series article 2: 5 reasons Dynamics 365 is a good CRM solution for wealth and pension providers and distributors in 2023

CRM Series article 3: Why a single source of truth matters to financial service providers

Contact us

Call: +442045742661

email: info@hesmur.com

Co-authored by Jim C Smith and Christopher Hess