Summary

During times of economic downturn and uncertainty, it can be tempting for wealth and pension firms to trim the fat and rationalise, but we argue a frugal and cautious approach could harm your sales effectiveness; it will be sales that get you through the challenging times and so it is vital to ensure you sales function is robust, motivated and resilient.

This article offers advice on how to build sales resilience in the face of challenging conditions, so that you’re prepared for when the tide goes out.

This article, at a glance

- The continuing theme of resilience

- What not to do during economic downturn

- How to build a more resilient sales and distribution function

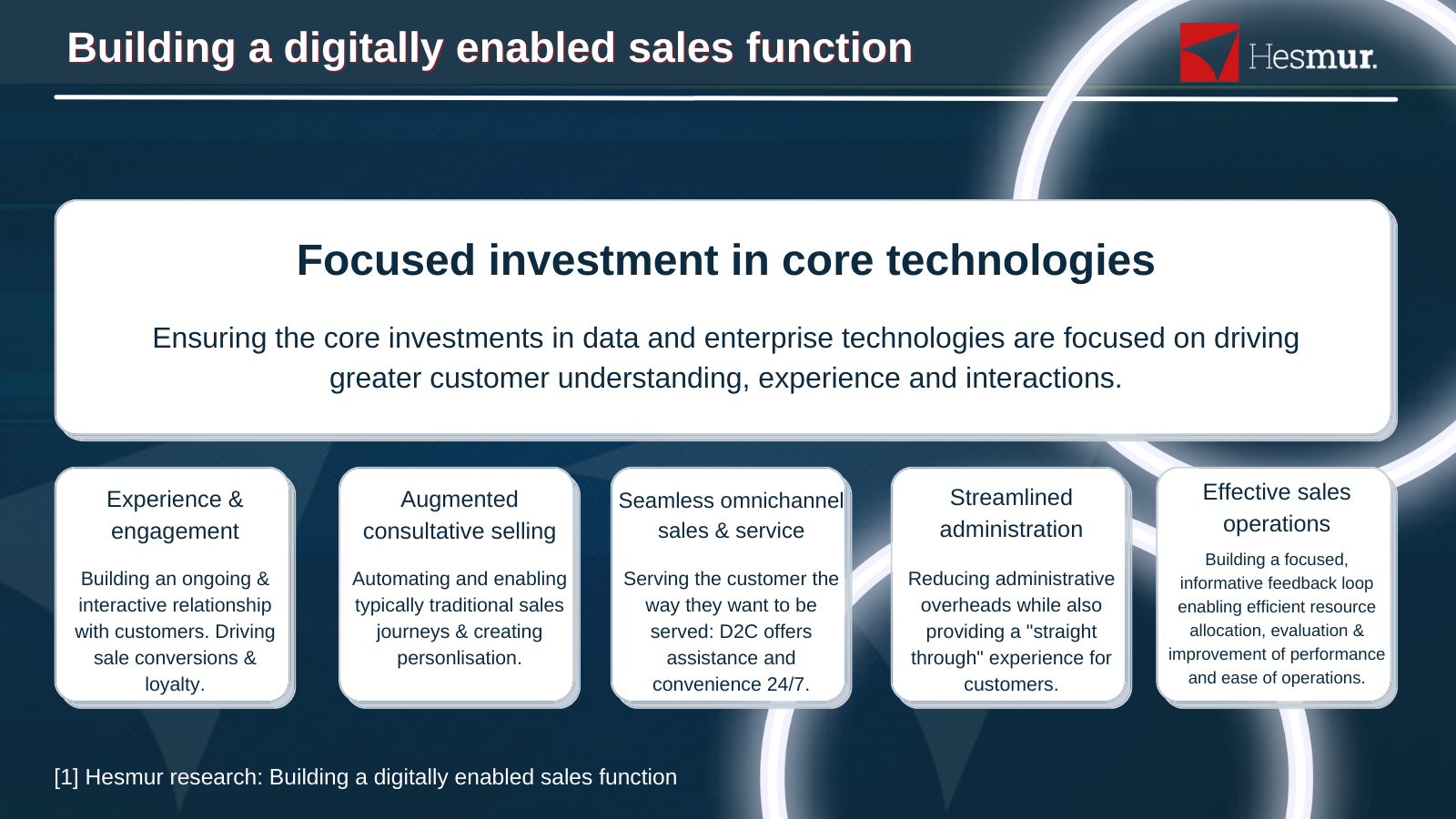

- Building a digitally enabled sales function by focusing investment in core technologies.

If we were to pick a theme for 2023, it would be resilience, as leaving yourself open to vulnerability in uncertain market conditions is not an option when conditions are as unpredictable and challenging as today.

To quote the successful American investor Warren Buffett, “it’s only when the tide goes out that you know who’s been swimming naked. ” in other words, don’t expect the wave to come in, but prepare for the tide to go out. And that’s precisely what wealth and pensions providers should do as we brace ourselves for further challenges.

With forecasts of a “sharp and prolonged” economic downturn[1] and rocky market conditions expected to reduce business flows in wealth and pensions, it is more important than ever to ensure your sales and distribution team is up to the challenge and isn’t left naked when the tide turns.

As the market constricts, distributors and manufacturers will be chasing a shrinking pool of clients and client money. And to compound this issue, many sales and distribution professionals in today’s market have never experienced this sort of downturn, so they may be ill-equipped to deal with the challenges ahead.

The months and years ahead will show us who has been “swimming naked” and not investing in their core sales and distribution capabilities.

Underpinned by in-depth interviews[2] with industry leaders and academics in the UK, Europe, Canada and further afield, we look at how pensions and wealth firms can build a more resilient sales organisation, keep sales teams focused and motivated, and prepare for the ever-changing sales landscape.

What not to do during economic downturn

Rationalise your sales teams

A typical response to reducing business volumes is to reduce sales teams accordingly. But, this false logic fails to consider that opportunities are much harder to close in these periods. A reduction in sales teams will likely accelerate this fall in volumes.

“Just work harder.”

Another common response by sales managers and professionals alike is to “just work harder”. This could be increasing contact targets, booking more client meetings per day, or promoting a wider set of products and services. If your teams are already working at their optimum levels, this will likely decrease their focus and even reduce the number of opportunities that close. The phrase busy fools springs to mind, and this mindset only serves to demotivate and reduce output quality.

Stop investing in your infrastructure

With the market and customer preferences continuing to evolve, ensuring your infrastructure is evolving with it is more important than ever. Aside from the efficiency improvement opportunity, there is also a tangible revenue driver. End clients and distribution partners will have that much more choice in choosing partners; an ageing infrastructure that is difficult to work with could be the factor that makes them look elsewhere.

How to build a more resilient sales and distribution function

Listen to the market!

It is a truism to say that the first step in selling is having a product people want. Staying abreast of changing customer dynamics is the first step in building a resilient sales organisation. In our planning and executing in uncertainty series, we outlined questions firms can ask when faced with uncertainty. Regularly asking these fundamental questions will go a long way to building your ability to serve customers and drive sales activities.

Is my proposition still relevant? Does it need to be adjusted to meet changes in customer behaviour or other environmental factors? [3]

In some cases, the answers to these questions will be obvious, but where the answer is more subtle, the feedback loop from the sales teams and other customer intelligence is essential.

We are all on the same team!

An organisation’s culture goes a long way to building resilience in times of unexpected shocks or changes in customer dynamics. While a customer focus will help ensure you are on top of any changes in market dynamics, a true focus on employees will help ensure everyone is focused on solving the problem rather than looking over their shoulders.

As a key driver of organisational agility, this employee empowerment focus helps build a more agile culture, better able to react (and willing to respond) to situations that arise.

In sales organisations, employee support and investment are essential under challenging times. The sales organisation is the closest point of contact with your customers but is also the most severely impacted during difficult times due to high commission levels and variable compensation.

Taking a long-term view and bolstering the sales organisation in times of difficulty helps make the best of the hard times and helps maintain customer relationships and prepare for the future.

“The best sales leaders focus on communicating a clear vision of where the organisation needs to go and demonstrating a commitment to their people.” [4]

Build a robust sales infrastructure – even if you don’t think you need it now

In good times, few pay attention to how sales are happening and if targets are being met. The pandemic brought several existing issues in many sales infrastructures into sharp focus and gave us several new ones for good measure.

Considerations for building a robust sales infrastructure

People and capabilities

At its core, sales are about people: the customers you are selling to and the sales teams that connect with those customers. Ensuring your sales teams have the required skills, capabilities, and appropriate tools to deal with changing environments is critical. Where any of these things need to be improved, training and/or augmented tools and technology can help maintain resilience. Assessing your sales force capabilities:

- Do they understand the changing sales drivers for their customers?

- Do they aware of and understand all the products/suite of products they sell?

- Can they work across all channels customers require (Remote, face-to-face and digital if needed)?

- Are they able to build relationships with customers and stay engaged through long sales cycles and over the life of the customer relationship (even when it is difficult, in the example of Covid-19! )?

- And most importantly, are they able to maintain customer understanding, core sales capability and eq, even in times when it is difficult to maintain a relationship?

If the answer to any of the above is no, bolstering your training and supporting infrastructure could pay dividends.

Digital EQ

Understanding your customers’ needs and motivations is a critical part of effective selling. When traditional ways of interacting are interrupted, it is easy for sales teams to lose touch with customers and the drivers to their purchasing decisions.

Regardless of the industry, using digital tools to augment this core sales capability and “EQ” (emotional intelligence quotient) is critical to building a resilient sales organisation capable of weathering the storm of changing customer dynamics. Available tools include everything from the better use of remote engagement tools, crm and customer data management, through to dynamic “voice of the customer” monitoring and natural language processing sales enablement.

Read more about Digital EQ: How can fincancial service intermedaries build digital EQ and why does it matter?

Process management

While many view sales as a “dark art”, the crisis has underlined the importance of rigorous process management that keeps people focused on:

- The customer

- Opportunities that will bring the greatest value, and

- Executing flawlessly when a sales opportunity does arise.

Technology has gone a long way in enabling and streamlining these processes, the focus on these core processes has enabled firms to continue to serve customers and drive sales activities even in crisis situations.

Performance management

Many traditional sales performance management frameworks often only focus on tracking “wins on the board”. This binary and rather blunt approach fails to capture the richness of intelligence through the sales cycle that enables a more finely tuned and resilient sales organisation. Understanding the drivers of success (and failure! ), whether it’s in identification, qualification, the ultimate sale or post-sales support and service, will add to the overall corporate intelligence and drive better sales decisions; in good times and bad.

Tools and technology

While most firms have evolved beyond when a sales infrastructure meant a rolodex and a company card, few outside of digital businesses fully take advantage of the available tools to streamline and enhance their sales organisations and build greater resilience. Our research has identified the following components of a robust sales technology infrastructure[5].

Experience and engagement – Building an ongoing and interactive relationship with customers.

Augmented consultative selling – Automating and enabling more traditional sales journeys.

Seamless omnichannel sales and service – Serving the customer how they want to be served: D2C when it suits them, with the option for assistance and advice when needed.

Streamlined administration – Reducing administrative overheads while also providing a “straight through” experience for customers.

Effective sales operations – Building a focused, informative feedback system enabling more efficient allocation of resources, evaluation and improvement of performance, and ease of operations.

Focused investment in core enterprise technologies – Ensuring the core investments in data and enterprise technologies are focused on driving greater customer understanding, experience and interactions. For more on this, see Steps to digitising sales and distribution in pensions investments and wealth.

Next steps

Nothing is more fundamental to business than being able to sell and deliver products and services to your clients and customers. While no one can truly predict the shocks the industry will face, we can prepare to meet them. Building greater resilience iner your sales organisation is the first step. As we face unknowns of the year to come, areas to focus on are:

- Focus on the fundamentals and continuously reassess your ability to deliver products and services that meet customers’ needs.

- Build towards a nimble and focused sales culture and give them the support and tools when they need it.

- Begin to build your resilient sales infrastructure with the rigour and flexibility to address any future change to come.

References

[1] WBG GEP january 2023 [2] Hesmur Research: market practices in driving greater sales resilience [3] Hesmur Research: strategic and business planning: insights on process and practices in prolonged uncertainty [4] Mckinsey & Company: Five actions to boost your sales organisations resilience, july 1, 2020 [5] Hesmur Research: building a digitally enabled sales function

Contact us

Call: +442045742661

email: info@hesmur.com

Hesmur is a digital transformation consultancy helping financial service organizations navigate and adapt to a rapidly changing data-driven world. Through rapid diagnostic and leading-edge digital delivery, we implement measurable change swiftly and effectively, and through our network of highly experienced professionals and data specialists, we use data-driven insights to help financial service organizations maintain that competitive edge with tailored and transformational consultancy services.