Sales and Distribution Digitisation Series

Synopsis

This article is part of the Sales and Distribution Digitisation Series and focuses on the use of social media as a sales tool in the financial services sector. The FS sector may be no stranger to social media marketing, but is its ability to build relationships with potential customers maximised?

Whilst retail and business banking providers show they are well versed in brand-level marketing, how can intermediaries in pensions and investments get the most out of brand-level and tactical campaigns?

This article at a glance:

- How retail and business banking providers are able to soften their brand image to connect with audiences in an authentic way.

- If 53% of the global population are on social media* and over 88% of the UK population actively use social media**, then social media is a channel that should not be dismissed by FS providers for lead generation.

- How financial service providers can make the most of the opportunity through their people and technology.

- This still-evolving channel comes with risks and challenges in the areas of compliance, sales management and brand management.

- A look at how to successfully manage the democratisation of social media as a sales channel through a bold vision, effective training, effective control mechanisms and ROI measurement.

Introduction:

It is widely agreed that social media platforms such as LinkedIn, Twitter, Facebook and Instagram are viable and established lead generation spaces for sales advisors, business development managers and marketers. Offering a dynamic, cost-effective and creative route to market, they enable brands to reach thousands of audiences, so social platforms have been leveraged successfully by marketers across industries. Retail and lifestyle brands have the right formula, but what about financial services? Is social media a viable sales nurturing channel in a regulatory and risk-averse sector?

Though retailers may be ahead of the curve and hone their social media acquisition marketing skills, the world of financial services is still a work in progress. How can a risk-averse and highly regulatory environment seize the opportunity the same way others have?

We examine this opportunity and discuss challenges that this still evolving channel brings concerning risk, regulation, management and C-suite investment.

The FS sector is no stranger to social media

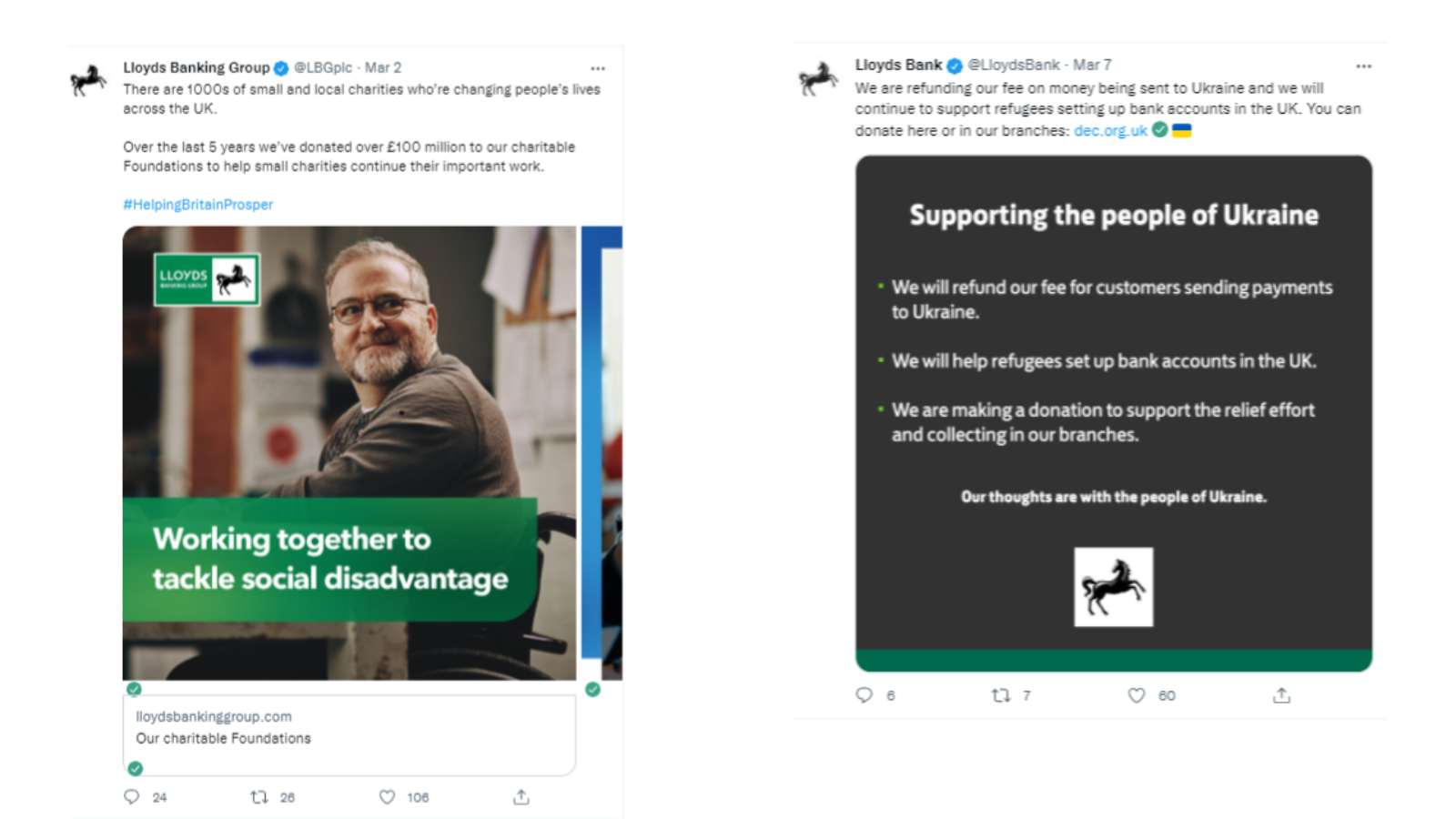

The financial services industry, albeit traditional, is well accustomed to social media marketing. When it comes to centrally published social media communications, the more prominent retail banks demonstrate maturity and authenticity in their social content and campaigns. They respect that audiences will not be fooled by sanitized sales content instead of showcasing real people in real situations and, in many cases, successfully demonstrating their values by sharing their social purpose in an impactful and authentic way.

Lloyds TSB, NatWest and Halifax seem to understand that customers relate to people and that placing human experiences and causes at the forefront can strengthen customer relationships. Such efforts are helping to close the gap created by the closing of retail bank locations and the impact of the pandemic.

Social media good practice examples, Lloyds Banking Group Twitter accounts:

Social media has been the vehicle for delivering a softer, empathetic voice to the customer for some years and has also enabled financial service marketers to deliver highly tailored advertising content, cleverly crafted to help the brand stay in front of mind, build trust, and establish relationships with potential customers early in the buying cycle. This centralized and controlled way of utilising social media holds efficacy. Still, the challenge lies in democratising the use of social channels for sales nurturing and customer acquisition through the field sales and advisor teams.

The opportunity

Be where your customers are

It stands to reason that a brand must be wherever its customers are and be visible and credible at the same time. Statistics point to a socially savvy and plugged-in world, where 53% of the global population are on social media* and over 88% of the UK population actively use social media**. It is not surprising that 79% of marketers adopt social media advertising as a means of growing awareness and generating leads and sales.

Not only are people responsive to vendor interaction on social platforms, but one-third of B2B buyers also use social media to engage with other business services. But audiences will only listen and engage if the brand or the representative holds authority and credibility. And times are rapidly changing, as there is an expectation from consumers to be able to engage with their brands online in a two-way dialogue. Those who fail to be visible fail to be relevant.

Softening the brand image and driving engagement

Being where your audiences are is not enough, and simply having a social media presence doesn’t guarantee success for customer relationships, brand building or customer acquisition. People relate to people, and so any way to soften the often corporate and dull perception of financial services is going to work in the brand’s favour. By empowering the sales force to utilize social platforms, financial services providers can further humanize the brand and deliver what is traditionally viewed as dry and dull subjects relatable and engaging. With the proper training, the representative can provide information in an easy-to-understand and relatable way, helping expand brand reach, drive engagement, and deliver conversions.

Making the most of in-house skills and tools

When managing this new type of lead generation activity, an already established social media team or outsourced specialists mean the skills and tools required to plan, execute and manage this new social selling are already in place. Most financial services companies aren’t starting from scratch. It is more a case of applying existing tools, skills and resources in a new way to effectively manage this new route to market, with minimal risk by those in compliance and governance.

And by collaborating with HR teams, financial service marketers can demonstrate and train sales exactly how to deliver content that adds value and helps potential new customers address issues, solve a problem or learn. If done correctly, the sales team can extend the reach of social content by leveraging their networks, whether by sharing marketing-generated content, curated content or the salesperson sharing their learned specialist knowledge.

Successful marketing automation can act as a new lead-generation channel for the sales and distribution teams whilst also helping with brand-building. Marketing software can further support the sales function by attracting and nurturing potential new customers on a larger scale than can be achieved by a single salesperson. Marketing qualified leads can then be passed to the advisor or sales representative. However, few financial service providers have the right tools in place to be able to deliver successful marketing automation campaigns to new or existing audiences due to dated and ineffective tech stacks.

Knowing the customer

A salesforce that has its eyes and ears in the social sphere will be able to gain invaluable insights into prospects, customers and competition. Offering financial service providers another way to truly ‘know the customer’, and the smartest will leverage this knowledge of the broader market and competitive environment. Feeding it back to the central marketing team to strengthen marketing communications and tactical campaigns.

And this listening and understanding work both ways, as social media is the modern word-of-mouth. Being publicly visible with a vast digital reach can work for and against brands, yet this is where the inherent risk lies. Financial service providers are incredibly cautious, and for a good reason. It is not a case of if a social media crisis occurs, but when. And a PR disaster can hit any organisation hard.

A cost-effective channel

Besides resources, training and risk, social media selling is still an attractive and cost-effective channel for marketers. Social media advertising has a far more favourable cost-per-click for the finance sector than other advertising channels such as Google AdWords. And the ability to tell more of a story and build trust through highly tailored content makes it an impactful and higher converting route to market than other channels in some instances, resulting in a more attractive cost per acquisition.

The opportunity and the merits are clear in terms of brand awareness and lead generation. Although the industry may be well-versed in the social media sphere in terms of centrally controlled content, there are a variety of challenges that come with opening and democratising social media as an additional sales channel for advisors. Brands may do well to harness sales teams’ willingness and ability to adopt this untapped channel but should be cautious of the risk it presents.

The challenges

The overriding challenge for financial service companies comes in monitoring and controlling the activities of their sales teams, who are increasingly adopting social media as another route to market. Regardless of the sector, this is a tricky game for marketing and communications departments, yet the risk is even greater for finance marketers.

Accountability and productivity

With FS companies being a traditional and risk-averse sector, the idea of allowing its sales teams to manage activity outside of a CRM raises concerns around visibility, accountability, and compliance. Not only that, but how can managers and leaders be sure that it is time well spent? After all, precious hours on LinkedIn or Twitter can seem counterintuitive, as time could be spent picking up the phone, sending emails out or on the road meeting with clients who are ready to buy. Moving away from the status quo and the traditional sales model can seem risky when new methods are yet to prove ROI.

The pressure to prove its value and demonstrate a return on investment only grows as the investment of resources increases. Continuing to challenge marketers and sales teams who must show the correlation between social activity and sales lead generation. This is possible when marketing maturity is established and the right processes and tools are in place to measure. For those more cautious and traditional, gaining initial buy-in can be difficult as they don’t have the means to demonstrate its value. In these instances, outsourced social media expertise could be need demonstrate best practices, case studies and support in strategy and planning.

Brand image and social media crises

For the naive and un-initiated social media prospecting could spell a PR disaster or, at the very least result in an undesirable brand image. Audiences don’t like to be sold to, and any positive sentiment towards a brand can be killed off in one fell swoop by a poorly thought through or timed post or direct message. Using blunt or traditional sales pitches will damage even the most well-established relationship. The tongue-in-cheek image below is a viral piece of content from marketers that mock this misalignment demonstrating the frustrations around the lack of control over sales-led LinkedIn content.

The business meme that went viral b– ‘marketing department’s reaction to salespeople creating their own LinkedIn content.’

The importance of training salespeople to use social media in a sensitive and authentic way and being social media literate can’t be stressed enough.

Regulation and compliance

Strict regulation and the ongoing ambiguity from the FSA continue to prevent some financial service operators from truly embracing social media as a lead generation channel. And the industry is cautious for a good reason, as, in February 2022, the FSA warned investment firms about using social media influencers in their marketing communications following the case of a ‘fin-influencer’ driving traffic to an investment app, which was regarded as irresponsible. The FSA has since announced “a significant strengthening of its rules” **** as a result, and it is expected to release further guidance in the coming months to control how high-risk financial products are marketed on social media to protect the most vulnerable.

Although many would agree that the risks are too great to ‘figure it out as they go along’, the combination of high regulation, late adoption from the financial services sector and ambiguity from regulatory bodies means evolution and learning is inevitable. Not only that, but how social media is leveraged and its pace makes it difficult to rein in. This all points to the need for continued vigilance by the FSA in this area.

Therefore, it is no surprise that leaders are nervous about the democratization of social media use amongst the sales force. This lack of belief makes any sizable investment difficult to obtain, hampering progress and making positive results and benchmarking challenging.

So how can finance marketers convince board-level executives that social media is a serious and viable sales channel? And even if they achieve backing, how would they plan, execute and control a democratized social media strategy?

Managing the democratization of social media as a sales channel

Creating a culture of accessibility and empowering teams to speak authentically and compliantly, requires a robust social media strategy, and that begins with having a crystal-clear view of the mission.

That means knowing the goals, who the audience is and being clear on guidelines and accountability. Understanding how the marketing team will collaborate with the sales force is also critical. As collaboration and open communication between both is vital if social platforms are correctly used by advisors and field sales teams. And so, the primary focus has to be on empowerment and support rather than rules and regulations. That said, there still needs to be a strong emphasis on what advisors can and can’t say about financial advice, products, or services in the public arena. These regulations are laid out in a comprehensive Social media and customer communications guide released by the FSA and regularly updated.

Social media etiquette is not a given. There is also the risk of rogue or renegade employees or advisors tarnishing the brand’s reputation in one fell swoop, potentially resulting in a PR disaster in a public arena where the risk for national media visibility and scrutiny is all too real. Yet, this risk can be minimized through training and robust social media policies driven and shaped by the aforementioned FSA social media guide.

By demonstrating to sales advisors how exactly they can deliver value and providing them with the right sales tools and guidance, they can overcome barriers to purchasing in a more productive and visible way.

Culture

Having a well-defined mission and a robust social media policy is not enough, as a positive culture of cross-functional collaboration should drive a clear vision. This means leadership understands its role and respects its value by ensuring their marketers have the necessary resources to execute an effective social media strategy.

Formulating a robust social media strategy requires an employee advocacy programme, compliance specialist, and HR personnel. And effective execution demands a unified approach to training and incentivising and supporting employees to succeed.

Training

Setting the scene, being clear on the mission and ensuring advisors understand the role of social media in their day-to-day sales activity is the first step.

A policy could easily be viewed as a ‘does and don’t list’ and quickly lose employee engagement if delivered poorly. Therefore, the challenge for leaders will be balancing compliance, creativity, and autonomy. To keep enthusiasm high whilst being unapologetic about the need for compliance and approval and supporting sales advisors to deliver value, not sell.

Social media marketers can help the advisors through publishing content that enables sales teams to educate and deliver value to their audiences yet allow enough freedom for the advisor to be able to humanize the delivery in a natural and relatable way.

Monitoring and control

Even with the best processes and planning, monitoring is essential to minimize risk and control activity. And today, there exists a variety of tech being used by finance marketers to monitor and measure their centrally created content.

Modern social media management tools are designed specifically for compliance and management, enabling scheduling, approval, and visibility of social media activity.

And when it comes to monitoring and managing activity delivered outside of the marketing team, there are also software solutions that enable social media teams to keep their finger on the pulse and know what is being said about and on behalf of the brand. This visibility and accountability reduce the perceived risk even further and gives confidence to those outside of the marketing function that activity is controlled and content is compliant.

And by providing a library of content to the field sales team, finance marketers can ensure that advisors and the field sales team have the right tools to establish and build relationships with credibility.

Proving ROI

Senior decision-makers fail to see the value of social media – often, this is a result of vanity KPIs being presented that do little to show the bigger picture or demonstrate how it impacts the sales pipeline. Therefore, marketers must focus on those KPIs that show social media contribution to the sales pipeline, reporting on clicks, conversions, leads and revenue. Many software applications integrate this social data into CRM dashboards for a full pipeline view offering complete accountability of the social activity.

And additional tools such as UTM tracking helps marketers build a clearer picture of the overall impact of social in terms of reach, clicks and conversions.

When fully integrated with CRM systems and using additional tools such as chatbots, the ability to capture, record and measure leads are becoming increasingly simpler. They enable accurate measurement and accountability of sales advisor time and effort and demonstrate the actual contribution to revenue.

When managed in this way, it reassures senior leaders of control and risk management and proves the efficacy of social media as a true lead generation channel. Even those who have struggled to appreciate how it could replace the traditional route to market and selling methodologies.

In a new digital age, even the most risk-averse traditional financial service providers must adapt and evolve to remain visible, relevant and credible.

Sources:

* Hubspot.com https://blog.hubspot.com/blog/tabid/6307/bid/23865/13-mind-bending-social-media-marketing-statistics.aspx

** https://www.statista.com/topics/3236/social-media-usage-in-the-uk/#dossierKeyfigures

Hesmur is a digital transformation consultancy helping financial service organizations navigate and adapt to a rapidly changing data-driven world. Through rapid diagnostic and leading-edge digital delivery, we implement measurable change swiftly and effectively, and through our network of highly experienced professionals and data specialists, we use data-driven insights to help financial service organizations maintain that competitive edge with tailored and transformational consultancy services.

Contact us

Call: +442045742661

email: info@hesmur.com